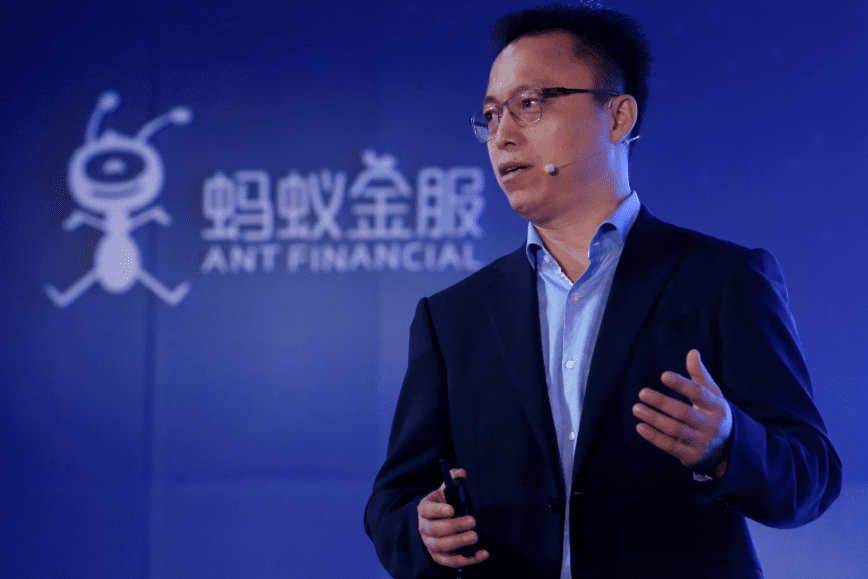

Welcome to an exclusive insider’s look into the vision behind BEYON FINANCE with its esteemed CEO. Get ready to delve into the mind of the mastermind behind this innovative financial institution, as we explore the motives, goals, and passion that drive this visionary leader. Through this unique perspective, you’ll gain a deeper understanding of the values and principles that shape BEYON FINANCE’s approach to revolutionizing the financial industry.

The Rise of Beyond Finance CEOs

Over the past decade, there has been a noticeable increase in the number of CEOs in the finance industry who are branching out beyond traditional financial services. These “Beyond Finance CEOs” are leading their companies to new heights by diversifying their offerings and exploring innovative ways to stay ahead of the competition.

One reason for this trend is the changing landscape of the financial industry. With advancements in technology and shifting consumer preferences, traditional financial services are no longer enough to sustain a company in today’s fast-paced world. Beyond Finance CEOs recognize the need to adapt and evolve, and they are taking bold steps to redefine their roles and responsibilities.

Furthermore, Beyond Finance CEOs understand the importance of staying relevant in a highly competitive market. By expanding their services beyond finance, they are able to attract a wider range of clients and appeal to new demographics. This diversification not only helps them grow their businesses but also creates opportunities for continued expansion and innovation.

Additionally, many Beyond Finance CEOs are driven by a desire to make a positive impact on society. By using their financial expertise to address social and environmental issues, they are able to contribute to the greater good while also achieving business success. This sense of purpose and mission-driven approach sets them apart from their more traditional counterparts and resonates with consumers who are increasingly conscious of the values and ethics of the companies they support.

Overall, the rise of Beyond Finance CEOs represents a shift towards a more dynamic and forward-thinking approach to leadership in the financial industry. By embracing change, taking calculated risks, and staying true to their values, these visionary leaders are able to navigate the complexities of the modern business world and drive their companies towards long-term success.

Leadership Strategies for Beyond Finance CEOs

As a Beyond Finance CEO, it is crucial to have strong leadership strategies in place in order to effectively lead your team and navigate the ever-changing landscape of the finance industry. Here are some key strategies that can help you succeed in your role:

1. Visionary Leadership: It is important for Beyond Finance CEOs to have a clear vision for the company and to effectively communicate this vision to their team. By setting a clear direction and inspiring others to follow, CEOs can drive their organizations towards success and growth.

2. Emotional Intelligence: Beyond Finance CEOs must possess a high level of emotional intelligence in order to effectively manage relationships with employees, clients, and stakeholders. This includes being able to empathize with others, communicate effectively, and resolve conflicts in a professional manner. CEOs who are emotionally intelligent are better equipped to handle the challenges that come with leading a finance company and can build strong, positive relationships within their organizations.

One way to enhance emotional intelligence is through self-awareness and self-regulation. CEOs can work on understanding their own emotions and reactions to different situations, as well as learning how to manage these emotions in a constructive way. By developing these skills, CEOs can become better equipped to handle the multitude of challenges they may face in their roles.

Additionally, CEOs can also work on improving their social skills, such as active listening, conflict resolution, and building rapport with others. These skills are essential for building strong relationships and fostering a positive work environment within the company.

3. Strategic Decision-Making: Beyond Finance CEOs must be able to make strategic decisions that will drive the company forward and ensure its long-term success. This includes analyzing market trends, assessing risks, and identifying opportunities for growth. By making informed and calculated decisions, CEOs can position their companies for success in a highly competitive industry.

4. Adaptability: The finance industry is constantly evolving, and Beyond Finance CEOs must be able to adapt to changes quickly and effectively. This includes staying informed about industry trends, technology advancements, and regulatory changes that may impact the company. CEOs who are adaptable can pivot their strategies in response to changing market conditions and ensure their organizations remain competitive in the long term.

5. Team Building: Building a strong and cohesive team is essential for Beyond Finance CEOs to achieve their goals and drive the company forward. CEOs must be able to recruit top talent, foster a positive work culture, and empower their employees to succeed. By investing in their team and providing the necessary support and resources, CEOs can create a high-performing organization that is capable of achieving its objectives.

By implementing these leadership strategies, Beyond Finance CEOs can position themselves for success in their roles and drive their companies towards growth and prosperity in the competitive finance industry.

Impact of Beyond Finance CEOs on the Industry

As the leaders of financial companies, Beyond Finance CEOs play a crucial role in shaping the industry and driving innovation. Their impact goes beyond just their own companies and extends to the entire financial sector. Here are three key ways in which Beyond Finance CEOs are influencing the industry:

1. Embracing Technology: Beyond Finance CEOs are at the forefront of adopting new technologies and integrating them into their businesses. They understand the importance of staying ahead of the curve and are willing to invest in cutting-edge solutions to enhance their services. By leveraging tools like AI, blockchain, and data analytics, Beyond Finance CEOs are able to streamline processes, improve customer experience, and gain a competitive edge in the market.

2. Fostering Innovation: Beyond Finance CEOs are not afraid to think outside the box and challenge the status quo. They encourage a culture of innovation within their organizations, empowering employees to come up with creative solutions to complex problems. By fostering a dynamic and entrepreneurial environment, Beyond Finance CEOs are able to drive continuous improvement and stay ahead of the competition.

3. Advocating for Diversity and Inclusion: Beyond Finance CEOs understand the importance of diversity and inclusion in today’s business landscape. They are committed to creating a more inclusive workplace, where individuals from different backgrounds and perspectives can thrive. Beyond Finance CEOs actively promote diversity initiatives, such as mentorship programs, networking events, and training sessions, to ensure that their organizations reflect the diversity of their customer base. By championing diversity and inclusion, Beyond Finance CEOs are not only driving social change but also reaping the benefits of a more innovative and productive workforce.

In conclusion, Beyond Finance CEOs have a significant impact on the industry by embracing technology, fostering innovation, and advocating for diversity and inclusion. Their leadership is shaping the future of finance, driving growth, and creating a more inclusive and dynamic sector. As the industry continues to evolve, Beyond Finance CEOs will play a crucial role in driving change and empowering their organizations to thrive in a rapidly changing landscape.

Challenges Faced by Beyond Finance CEOs

Being a CEO in the finance industry comes with its own set of unique challenges. Beyond finance CEOs are tasked with navigating a constantly evolving landscape of regulations, market trends, and customer expectations. Here are some of the most common challenges faced by those in leadership roles in the finance sector:

1. Regulatory Compliance: One of the biggest challenges for beyond finance CEOs is staying on top of ever-changing regulations. With new laws and guidelines being introduced regularly, it can be a daunting task to ensure that their company is in full compliance. Failure to adhere to regulations can result in hefty fines and damage to the company’s reputation.

2. Market Volatility: The finance industry is inherently volatile, with markets constantly fluctuating due to a variety of factors such as economic indicators, political events, and global trends. Beyond finance CEOs must be prepared to navigate through these fluctuations and make strategic decisions to protect their company’s financial health.

3. Technological Disruption: The advancement of technology has revolutionized the finance industry, with the rise of fintech companies and digital banking services. Beyond finance CEOs must adapt to these changes and ensure that their company is leveraging technology to stay competitive in the market. This may involve investing in new systems, training employees on digital tools, and implementing cybersecurity measures to protect sensitive data.

4. Talent Retention and Recruitment: In the competitive finance industry, attracting and retaining top talent is a major challenge for beyond finance CEOs. With new players entering the market and offering attractive compensation packages, it can be difficult to retain key employees. CEOs must create a positive work culture, offer opportunities for professional growth, and provide competitive salaries and benefits to attract and retain the best talent. Additionally, finding candidates with the right skills and experience can be a challenge, as the finance industry requires a specific set of expertise and knowledge.

5. Economic Uncertainty: Economic conditions can have a significant impact on the finance industry, with factors such as interest rates, inflation, and geopolitical events affecting market stability. Beyond finance CEOs must be prepared to navigate through periods of economic uncertainty and make informed decisions to protect their company’s financial assets. This may involve diversifying investments, hedging against risks, and staying informed on economic trends.

Overall, being a beyond finance CEO comes with a unique set of challenges that require strategic thinking, adaptability, and strong leadership skills. By staying ahead of regulatory changes, embracing technology, nurturing talent, and navigating through market fluctuations, CEOs can position their company for long-term success in the finance industry.

Future Trends for Beyond Finance CEOs

As technology continues to advance rapidly, Beyond Finance CEOs will need to adapt to new trends in order to stay ahead of the curve. One major trend that is becoming increasingly important for CEOs is the focus on sustainability and corporate social responsibility. In today’s world, consumers are becoming more conscious about the impact of their purchasing decisions on the environment and society. Beyond Finance CEOs will need to incorporate sustainability practices into their business models in order to attract and retain customers.

Another important trend for Beyond Finance CEOs is the rise of artificial intelligence (AI) and automation. AI has the potential to transform the way businesses operate, making processes more efficient and cost-effective. Beyond Finance CEOs will need to embrace AI technologies in order to remain competitive in the market. This may involve implementing AI-powered tools for data analysis, customer service, and risk management.

Furthermore, cybersecurity is another key trend that Beyond Finance CEOs need to be aware of. With an increasing amount of sensitive data being stored online, the risk of cyberattacks is higher than ever. CEOs will need to prioritize cybersecurity measures to protect their company’s data and reputation. This may involve investing in advanced cybersecurity systems and training employees on best practices for data protection.

In addition, diversity and inclusion have become important considerations for Beyond Finance CEOs. Companies that embrace diversity in their workforce have been shown to be more innovative and successful. CEOs will need to focus on creating a diverse and inclusive workplace in order to attract top talent and foster a positive company culture. This may involve implementing diversity training programs and setting diversity goals for hiring and promotion.

Lastly, the rise of remote work and flexible schedules is another trend that Beyond Finance CEOs will need to address. The COVID-19 pandemic has accelerated the shift towards remote work, and many companies are now considering making remote work a permanent option. CEOs will need to adapt to the changing work environment by implementing policies and technologies that support remote collaboration and communication. This may involve investing in remote work tools, creating flexible work schedules, and reevaluating the need for traditional office spaces.

Originally posted 2025-01-29 17:42:41.